100cr+

Investment Facilitated

Investment

Facilitated

25cr+

Investment Matured

Investment Matured

0%

Default

Default

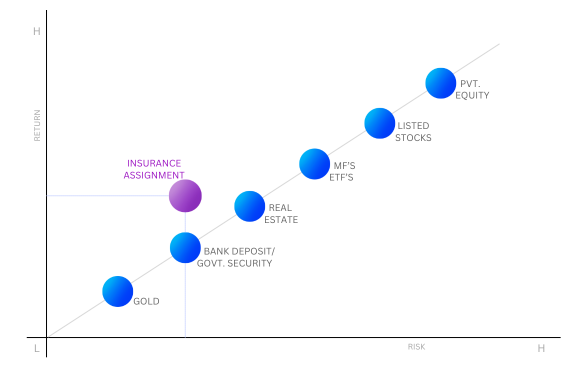

Looking for a Low-risk, High Return Investment Option?

The Policy exchange brings investment options in pre-owned life insurance policies at an attractive valuation leading to enhanced ROI

Pre-owned policies offer higher returns than traditional fixed income assets.

THE POLICY EXCHANGE

Fixed Deposit

Deposit MF

NSC

Kisan Vikas Patra

PPF

Pre Owned Insurance

Redefining Financial Futures:The Policy Exchange on Alt Investor

Get started with The Policy Exchange

in four easy steps

Don't just take our word for it

As an investor, I've been truly impressed with The Policy Exchange. Their seamless platform, transparency, and innovative solutions make investing effortless and secure. For those looking for a reliable, low-risk way to grow their wealth,

Nimish JainSoftware Engineer 2 at Microsoft

After reading about the concept of product offered by The Policy Exchange, I was intrigued and decided to try out a product. It was a smoother process with just the selection of your policy choice and then further process handled by The Policy Exchange.

Kunal AjmeraIT Manager

I chose to invest in pre-owned life insurance policies because they offer steady returns and aren't tied to stock market ups and downs. The process was clear and well-verified, which gave me confidence. It's a great way to diversify my investments while also helping policyholders get value from policies they no longer continuing

Amar KoradiaProduct Head - Nuvama